Virgin Money Wallet - Pay & Proposition

Project type: Enterprise Fintech - B2C

Role & responsibilities: Lead Product Designer, end-to-end user experience Wallet payment fuctionalty as well as prospotionTools: Figma, Sketch, Marvel, Miro

Opportunity

The Virgin Money Wallet aimed to create a unified Virgin ecosystem, positioning Virgin Money as the primary payment hub across all Virgin accounts and driving customer acquisition and sales. As part of our launch strategy, we aimed to partner with several Virgin companies, including Virgin Galactic, to become the first digital wallet in space!

Empathy & Define

Competitor Analysis

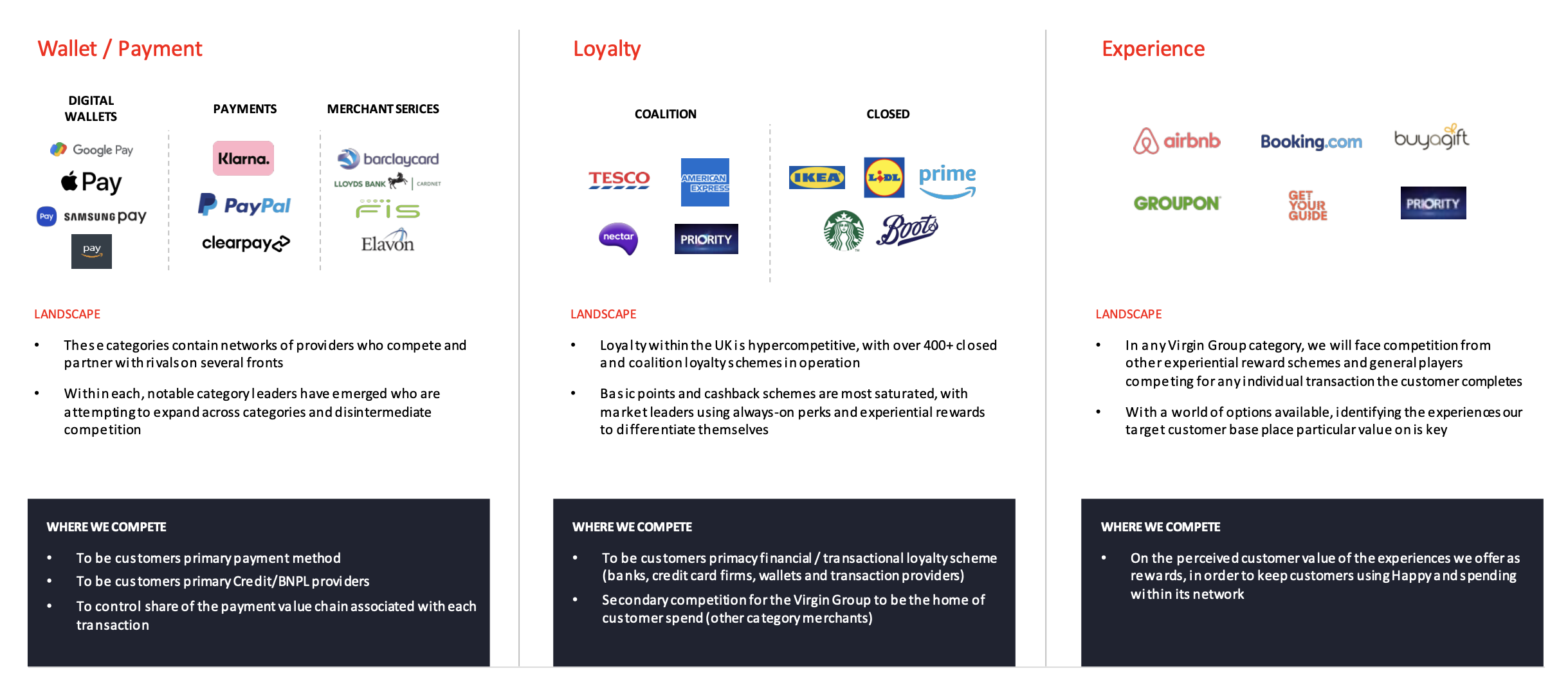

As discussed in my MVP case study, Virgin Money Wallet plays across Money, Loyalty and Experience, facing stiff competition for incumbents and disruptors in each. As a team, we did extensive competitor analysis and later feature analysis, to understand the different players in the 3 sectors below, payments being the one we focused on in this work group.

The Wallet competitor landscape

Research

We conduce more quant and qual research to understand the payments sphere, and how we would approach payments within the Wallet. We focused on answering 3 key questions to understand people’s desirability towards current payment methods and future payment mechanics, within 2 audiences.

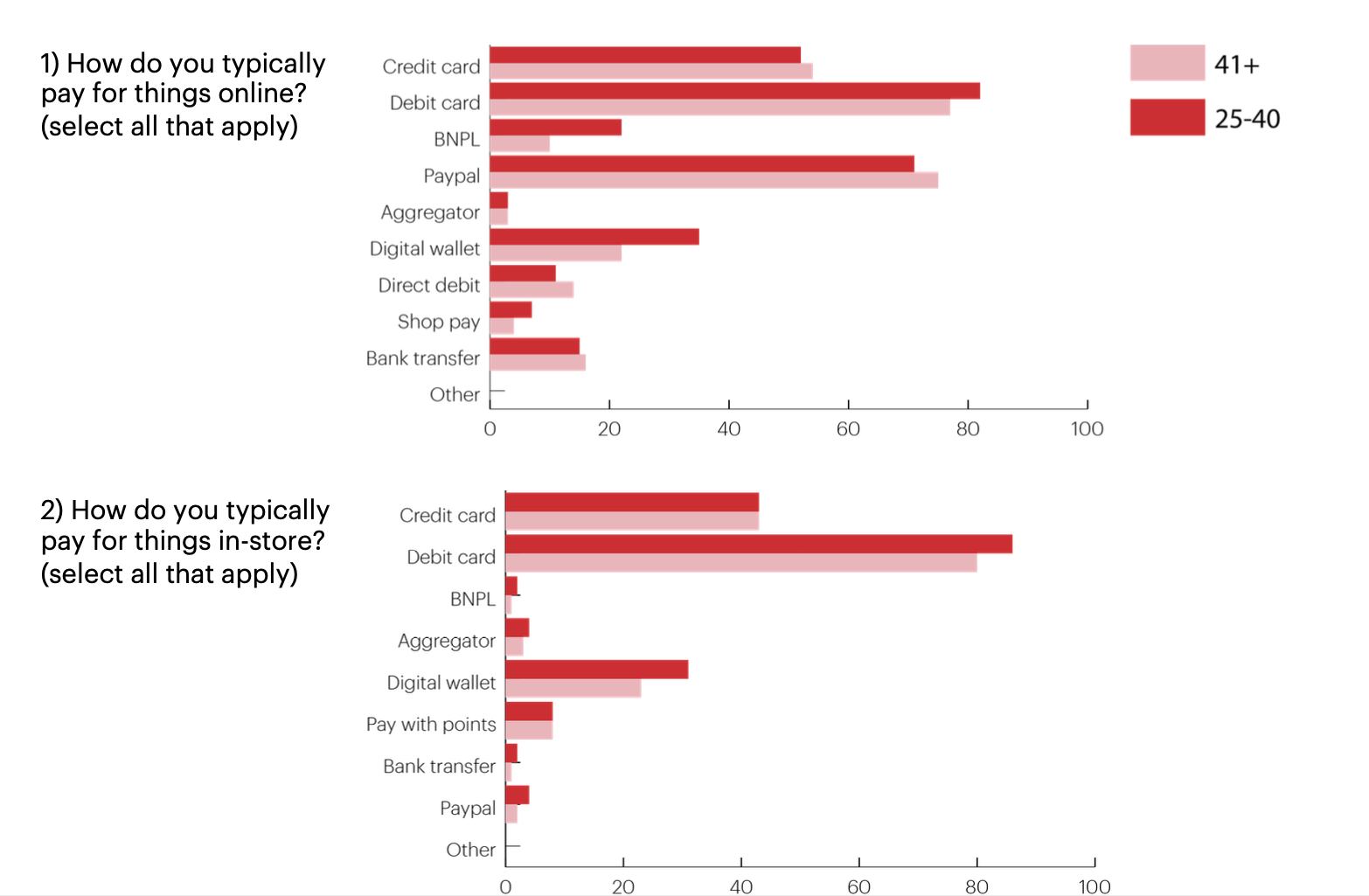

What payment methods do you currently use?

In the future, which payment mechanic would you use?

If you wouldn’t use these payment mechanics, how might we change your behaviour?

INSIGHT 01: Payment method is relatively consistent across both audiences

Wallet usage is higher with younger audiences

Debit and credit cards are universal payment mechanics and BNPL is used primarily for online purchases.

PayPal is a primary method of payment for online purchases

Implications: With our primary audience, wallets are being used so our challenge will be how to convince them to convert to Virgin Money Wallet. In order to take away market share for our online option, the checkout button must be as simple and safe as PayPal.

INSIGHT 02: Checkout online is the most popular payment mechanics across both age groups

People are more likely to use a checkout button than an aggregator online (58% vs 47%)

If they find the mechanic appealing then we will most likely use it

The older you are the more you expect points as an incentive – millennials prefer discounts at checkout from your favourite brands. Across all surveys (behaviour & incentives and payments) the top 4 incentives were: discount at checkout, points, little regular rewards (e.g. coffee), and personalised offer at checkout.

Personas & Scenarios

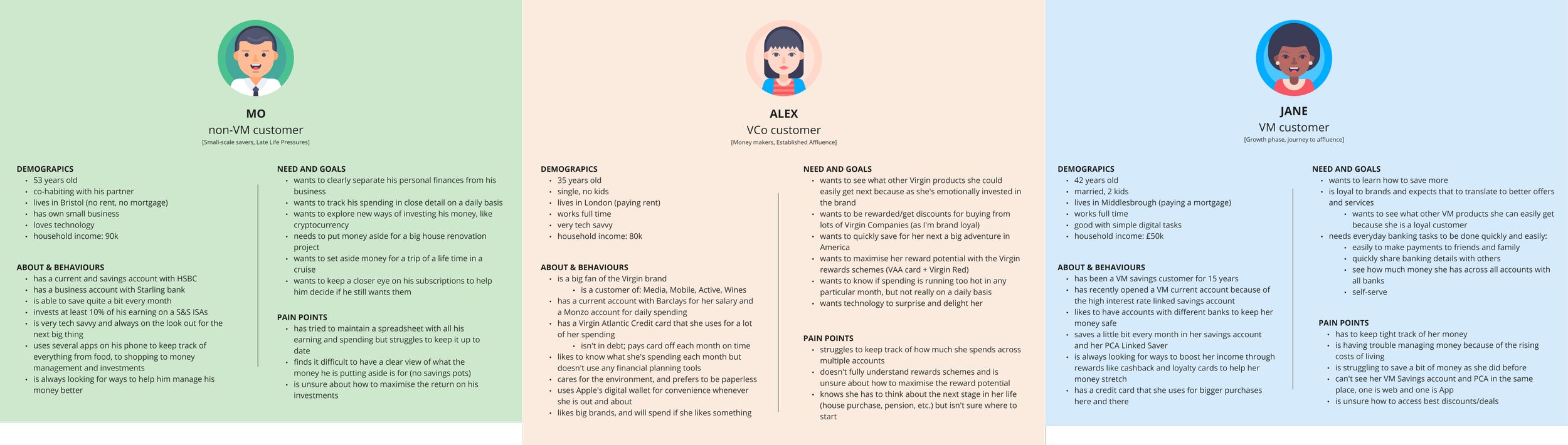

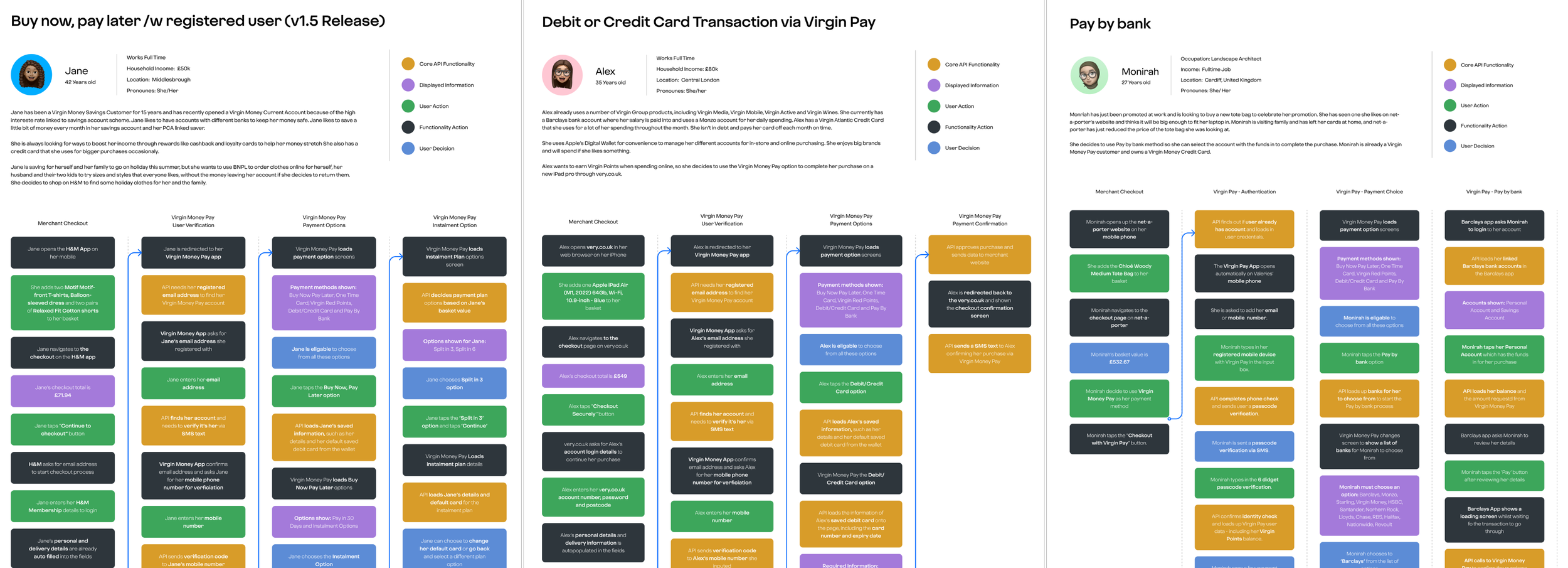

In collaboration with the Virgin Money research team, we created personas based on the bank's exciting personas, and on the recent research we conducted. We created scenarios to illustrate the relationship between the user journey and the intricate, technical diagrams we received from our business analyst team.

Working with the Virgin Money research team to create personas

Scenarios were created for each use case, here are a few examples

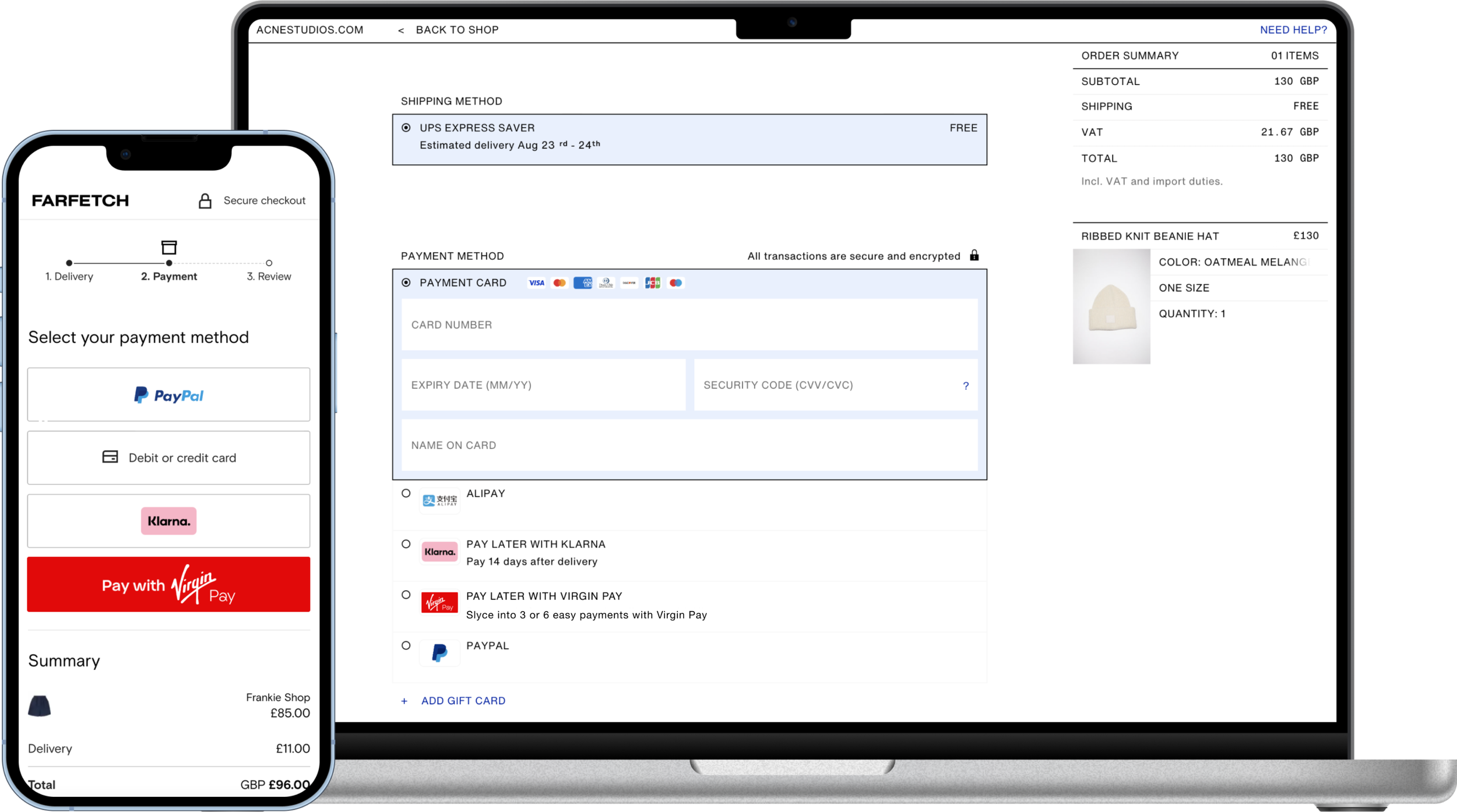

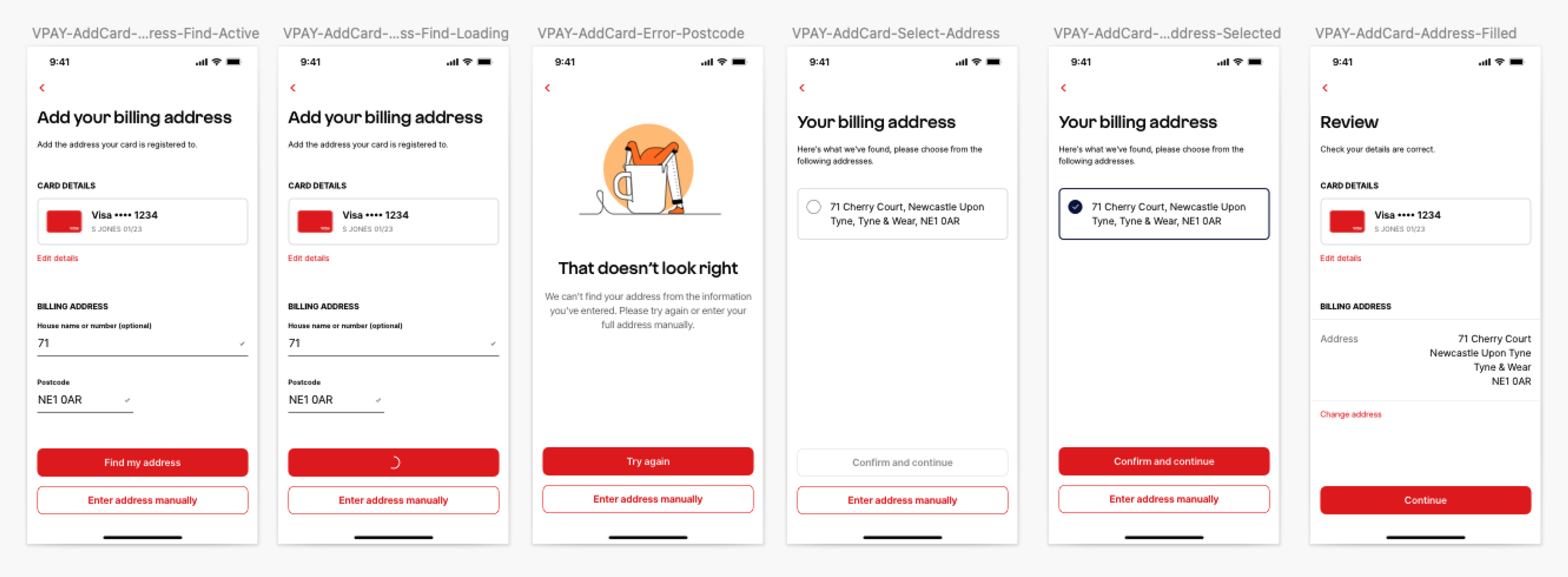

Mock of how the ‘Virgin Pay’ button could look at checkout

Ideate

The Wallet Payment team planned to expand on the MVP with hypotheses such as a "Virgin Pay" button, enabling seamless checkout from third-party sites within the app or browser, similar to PayPal or Clearpay.

Users would also be able to manage their cards from any bank, enjoy faster checkout while earning points and cashback, and eventually be able to pay with Virgin Points!

This echoed what we learned from our research and the team was confident in the proposition, but would continue to test this idea with users from the target audience.

Wireframe workshops

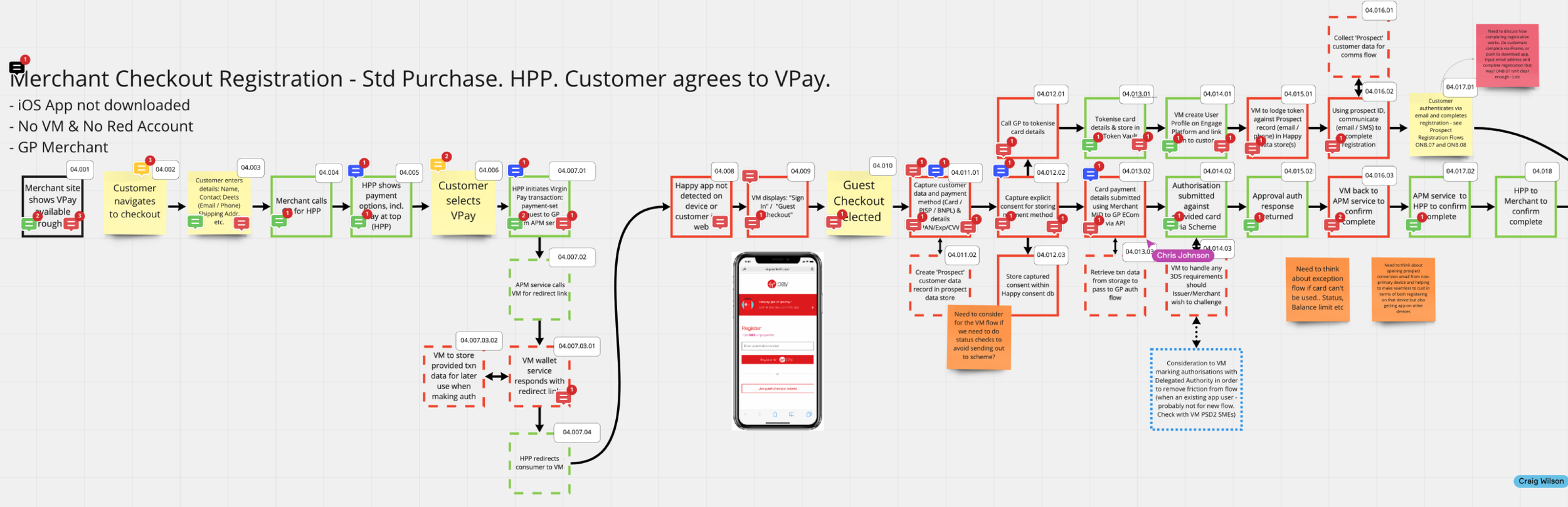

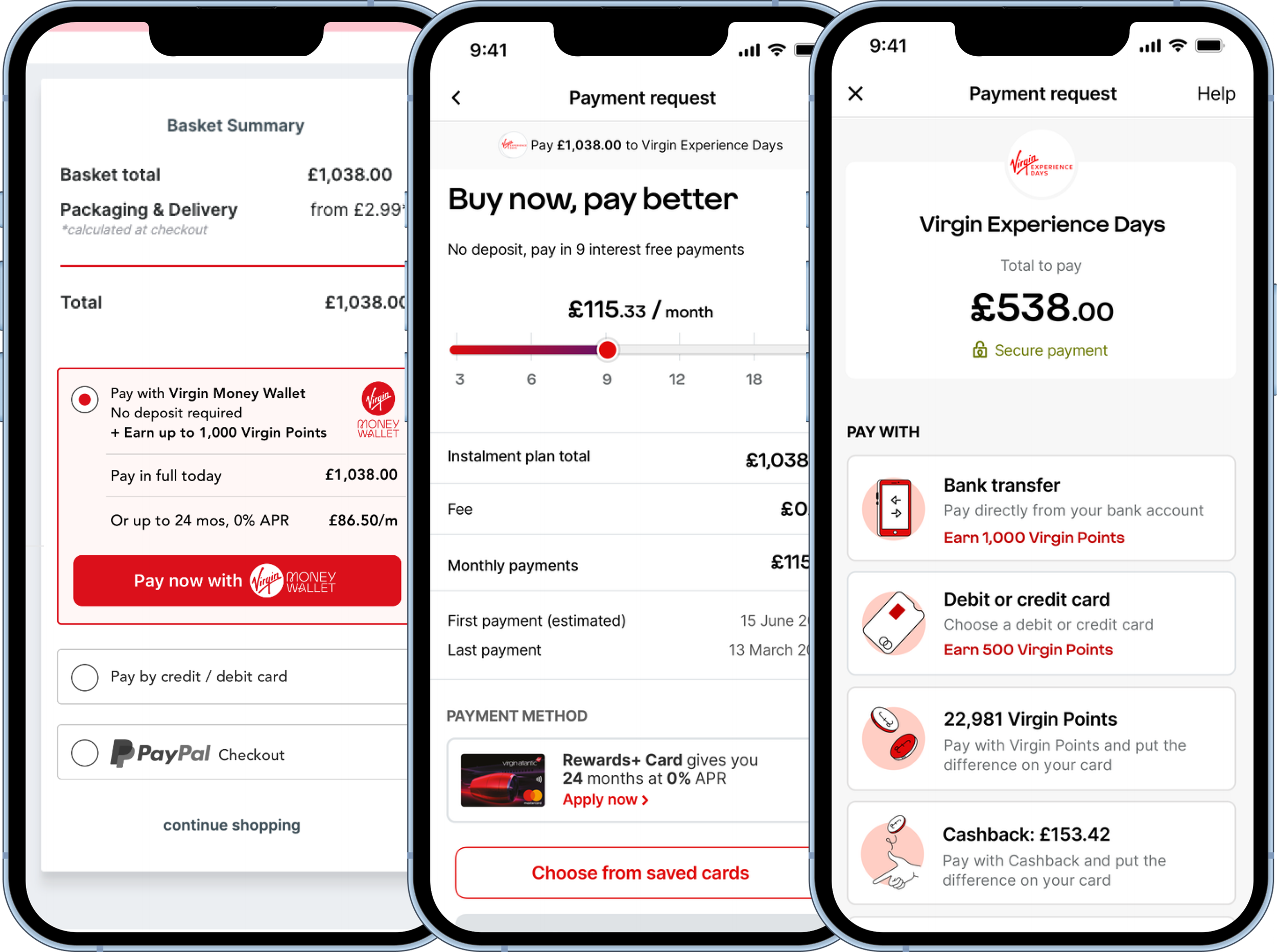

We worked closely with a team of business analysts, initially, all we had to go with as requirements were the technical diagrams below. ! conducted wireframe workshops to align with the wider team and senior stakeholders including architects, engineers, as well as security, fraud and risk teams. These workshops were pivotal to the whole project and helped us all align behind how user flows and journeys.

Technical flow from business analysts

During wireframes workshops we iterated with the broader team and stakeholders, and brought the user flows to life

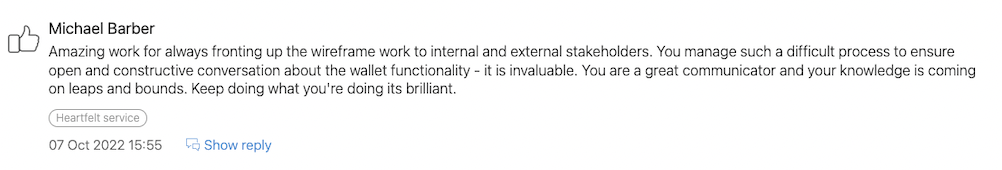

Feedback from our product owner

Prototype, test & iterate

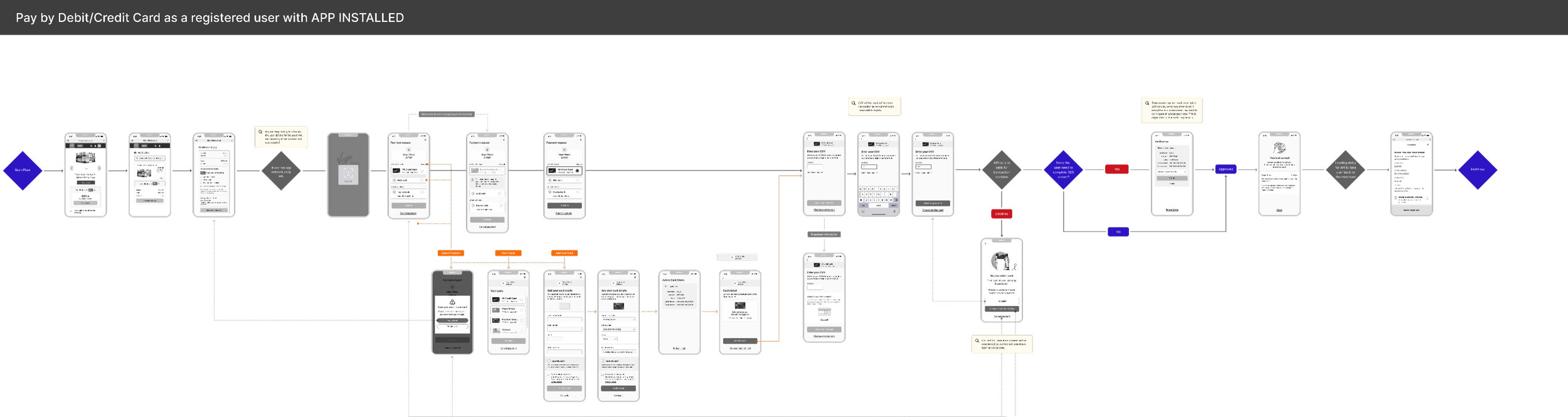

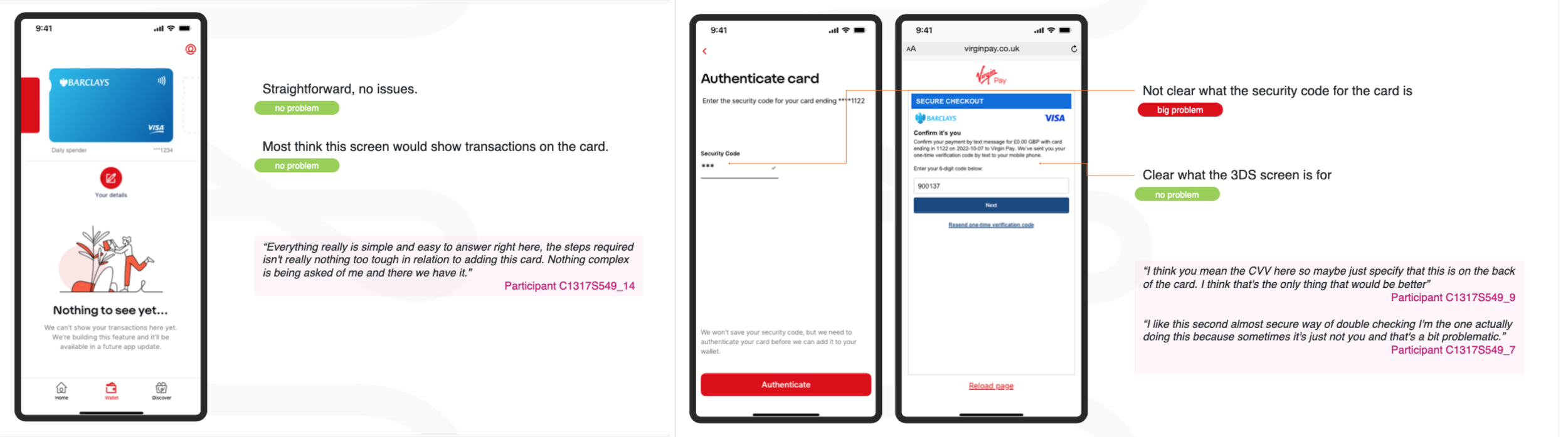

In collaboration with the research team, we conducted rounds of usability testing to iron out issues and reduce bias. By this point, my team had developed the wireframes into high-fidelity flows so that we could test usability more accurately.

We were also the first project in the bank to use the new 3.0 Design System and had to stress test components, eventually creating a detailed data dictionary.

Using Marvel we created prototypes to test every journey and used the insights gathered to inform design changes. The journeys for each payment method would include iOS, Android and web, and there would be a registered and unregistered user flow.

Along with our Virgin Money research team we conducted rounds of usability testing to iron out issues and reduce bias

‘Add a card’ journey, we used Overflow to illustrate the user flows and Marvel handoff to developers

The Wallet was the first project at the bank to test drive and collaborate on Virgin Money Design system 3.0.

Upsell & buy-in

As Lead Product Designer, I worked closely with the Head of Strategic Partnerships and Merchant Acquisition, to develop ideas in the payments, loyalty and engagement space; where I created hi-fidelity, interactive prototypes to secure internal stakeholder buy-ins, as well as promoting the Wallet as a payment method for Virgin Companies.

Virgin Money’s Digital Wallet aimed to leverage data insights and open banking to provide personalised experiences, deepen customer engagement, and drive targeted upsell opportunities. Features like Virgin Points, Cashback, and a points tracker allowed users to redeem rewards for services such as Virgin Active, fostering loyalty and repeat spending.

Supporting customer acquisition and retention, innovative features like a points tracker showed users their progress toward rewards, such as earning a companion voucher. This added personalisation (which we know is really valuable from our research) and also help increase user engagement and value. Dynamic in-app messaging enabled tailored offers, for instance on Virgin Hotels “Get a bottle of Prosecco with Virgin Money Wallet,” enhancing both acquisition and retention efforts.

The Wallet also delivered spend insights to boost customer stickiness and merchant value, with tools like real-time dynamic pricing and exclusive advertising opportunities. Instant issuance capabilities, initially with Virgin Atlantic, streamlined payments, while a ‘Virgin Pay’ browser plugin allowed point redemption without direct merchant integration. By combining customer data with innovative features, the Wallet aimed to drive incremental sales and help merchants grow their customer base.

Our process lead to converting 6 out of the 10 Virgin Companies to agree in principle to supporting with our launch strategy!